State Bank of India

Clash Royale CLAN TAG#URR8PPP

Clash Royale CLAN TAG#URR8PPP  | |

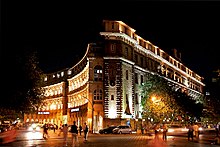

State Bank Bhavan at Nariman Point in Mumbai | |

Type | Public |

|---|---|

| Traded as |

|

| Industry | Banking, financial services |

| Founded |

|

| Headquarters | Mumbai, Maharashtra |

Area served | Worldwide |

Key people | Rajnish Kumar (Chairman) |

| Products | Consumer banking, corporate banking, finance and insurance, investment banking, mortgage loans, private banking, private equity, savings, securities, asset management, wealth management, credit cards |

| Revenue |

₹210,979 crore (US$31 billion) (2017) |

Operating income |

₹50,848 crore (US$7.4 billion) (2017) |

Net income | ₹10,484 crore (US$1.5 billion) (2017) |

| Total assets |

₹3,445,121 crore (US$500 billion) (2017) |

| Total equity | ₹2.171 trillion (US$32 billion) (2016) |

| Owner | Government of India (61.23%) |

Number of employees | 278,872 (2017) |

| Website | sbi.co.in |

Footnotes / references [1][2][3][4] | |

State Bank of India (SBI) is an Indian multinational, public sector banking and financial services company. It is a government-owned corporation headquartered in Mumbai, Maharashtra. The company is ranked 216th on the Fortune Global 500 list of the world's biggest corporations as of 2017. It is the largest bank in India with a 23% market share in assets, besides a share of one-fourth of the total loan and deposits market.[5][6]

The bank descends from the Bank of Calcutta, founded in 1806, via the Imperial Bank of India, making it the oldest commercial bank in the Indian subcontinent. The Bank of Madras merged into the other two "presidency banks" in British India, the Bank of Calcutta and the Bank of Bombay, to form the Imperial Bank of India, which in turn became the State Bank of India in 1955.[7] The Government of India took control of the Imperial Bank of India in 1955, with Reserve Bank of India (India's central bank) taking a 60% stake, renaming it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India.[citation needed]

Contents

1 History

2 Operations

2.1 Domestic presence

2.2 International presence

2.3 Former Associate Banks

2.4 Non-banking subsidiaries

2.5 Other SBI service points

3 Listings and shareholding

4 Employees

5 Recent awards and recognition

6 See also

7 References

8 External links

History

Share of the Bank of Bengal, issued 13 May 1876

Seal of Imperial Bank of India

The roots of the State Bank of India lie in the first decade of the 19th century when the Bank of Calcutta later renamed the Bank of Bengal, was established on 2 June 1806. The Bank of Bengal was one of three Presidency banks, the other two being the Bank of Bombay (incorporated on 15 April 1840) and the Bank of Madras (incorporated on 1 July 1843). All three Presidency banks were incorporated as joint stock companies and were the result of royal charters. These three banks received the exclusive right to issue paper currency till 1861 when, with the Paper Currency Act, the right was taken over by the Government of India. The Presidency banks amalgamated on 27 January 1921, and the re-organised banking entity took as its name Imperial Bank of India. The Imperial Bank of India remained a joint stock company but without Government participation.

Pursuant to the provisions of the State Bank of India Act of 1955, the Reserve Bank of India, which is India's central bank, acquired a controlling interest in the Imperial Bank of India. On 1 July 1955, the Imperial Bank of India became the State Bank of India. In 2008, the Government of India acquired the Reserve Bank of India's stake in SBI so as to remove any conflict of interest because the RBI is the country's banking regulatory authority.

In 1959, the government passed the State Bank of India (Subsidiary Banks) Act. This made SBI subsidiaries of eight that had belonged to princely states prior to their nationalization and operational takeover between September 1959 and October 1960, which made eight state banks associates of SBI. This une with the first Five Year Plan, which prioritised the development of rural India. The government integrated these banks into the State Bank of India system to expand its rural outreach. In 1963 SBI merged State Bank of Jaipur (est. 1943) and State Bank of Bikaner (est.1944).

SBI has acquired local banks in rescues. The first was the Bank of Bihar (est. 1911), which SBI acquired in 1969, together with its 28 branches. The next year SBI acquired National Bank of Lahore (est. 1942), which had 24 branches. Five years later, in 1975, SBI acquired Krishnaram Baldeo Bank, which had been established in 1916 in Gwalior State, under the patronage of Maharaja Madho Rao Scindia. The bank had been the Dukan Pichadi, a small moneylender, owned by the Maharaja. The new bank's first manager was Jall N. Broacha, a Parsi. In 1985, SBI acquired the Bank of Cochin in Kerala, which had 120 branches. SBI was the acquirer as its affiliate, the State Bank of Travancore, already had an extensive network in Kerala.

There has been a proposal to merge all the associate banks into SBI to create a single very large bank and streamline operations.[8]

The first step towards unification occurred on 13 August 2008 when State Bank of Saurashtra merged with SBI, reducing the number of associate state banks from seven to six. On 19 June 2009, the SBI board approved the absorption of State Bank of Indore. SBI holds 98.3% in State Bank of Indore. (Individuals who held the shares prior to its takeover by the government hold the balance of 1.7%.)[9]

The acquisition of State Bank of Indore added 470 branches to SBI's existing network of branches. Also, following the acquisition, SBI's total assets will approach ₹10 trillion. The total assets of SBI and the State Bank of Indore were ₹9,981,190 million as of March 2009. The process of merging of State Bank of Indore was completed by April 2010, and the SBI Indore branches started functioning as SBI branches on 26 August 2010.[10]

On 7 October 2013, Arundhati Bhattacharya became the first woman to be appointed Chairperson of the bank.[11] Mrs. Bhattacharya received an extension of two years of service to merge into SBI the five remaining associated banks.

Operations

SBI provides a range of banking products through its network of branches in India and overseas, including products aimed at non-resident Indians (NRIs). SBI has 16 regional hubs and 57 zonal offices that are located at important cities throughout India.

Domestic presence

Samriddhi Bhavan, Kolkata

SBI has 18,354 branches in India.[12] In the financial year 2012–13, its revenue was ₹2.005 trillion (US$29 billion), out of which domestic operations contributed to 95.35% of revenue. Similarly, domestic operations contributed to 88.37% of total profits for the same financial year.[12]

Under the Pradhan Mantri Jan Dhan Yojana of financial inclusion launched by Government in August 2014, SBI held 11,300 camps and opened over 3 million accounts by September, which included 2.1 million accounts in rural areas and 1.57 million accounts in urban areas.[13]

International presence

The Israeli branch of the State Bank of India located in Ramat Gan

As of 2014–15, the bank had 191 overseas offices spread over 36 countries having the largest presence in foreign markets among Indian banks.[14]

SBI operates several foreign subsidiaries or affiliates.

In 1989, SBI established an offshore bank: State Bank of India International (Mauritius) Ltd in Mauritius. SBI International (Mauritius) Ltd amalgamated with The Indian Ocean International Bank, which has been doing retail banking business in Mauritius since 1979 with the new name, SBI (Mauritius) Ltd. Today, SBI (Mauritius) Ltd is having fully integrated 14 branches- 13 Retail Branches covering major cities and towns of Mauritius, including Rodrigues, and 1 Global Business Branch at Ebene in Mauritius. Apart from Branch Banking, customers also have the convenience of 24x7 ATM Banking at 18 ATMs across the country. Bank also has a 24x7 robust Internet Banking Channel enabling customers to work from their homes and offices.

[15]

SBI Sri Lanka now has three branches located in Colombo, Kandy and Jaffna. The Jaffna branch was opened on 9 September 2013. SBI Sri Lanka, the oldest bank in Sri Lanka, celebrated its 150th year in Sri Lanka on 1 July 2014.

State Bank of India Branch at Southall, United Kingdom

In 1982, the bank established a subsidiary, State Bank of India, which now has ten branches—nine branches in the state of California and one in Washington, D.C. The 10th branch was opened in Fremont, California on 28 March 2011. The other eight branches in California are located in Los Angeles, Artesia, San Jose, Canoga Park, Fresno, San Diego, Tustin and Bakersfield.

In Nigeria, SBI operates as INMB Bank. This bank began in 1981 as the Indo–Nigerian Merchant Bank and received permission in 2002 to commence retail banking. It now has five branches in Nigeria.

In Nepal, SBI owns 49% of SBI Nepal (State Bank in Nepal) share with Nepal Government owing the rest and SBI NEPAL has branches throughout the country in each and every city as banking has become the major part of daily life for Nepalese people.

In Moscow, SBI owns 60% of Commercial Bank of India, with Canara Bank owning the rest.

In Indonesia, it owns 76% of PT Bank Indo Monex.

The State Bank of India already has a branch in Shanghai and plans to open one in Tianjin.[16]

In Kenya, State Bank of India owns 76% of Giro Commercial Bank, which it acquired for US$8 million in October 2005.[17]

In January 2016, SBI opened its first branch in Seoul, South Korea following the continuous and significant increase in trade due to the Comprehensive Economic Partnership Agreement signed between New Delhi and Seoul in 2009.

Former Associate Banks

Main Branch of SBI in Mumbai

SBI acquired the control of seven banks in 1960. They were the seven regional banks of former Indian princely states. They were renamed, prefixing them with 'State Bank of'. These seven banks were State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Indore (SBN), State Bank of Mysore (SBM), State Bank of Patiala (SBP), State Bank of Saurashtra (SBS) and State Bank of Travancore (SBT). All these banks were given the same logo as the parent bank, SBI.

The plans for making SBI a single very large bank by merging the associate banks started in 2008, and in September the same year, SBS merged with SBI. The very next year, State Bank of Indore (SBN) also merged. In the same year, a subsidiary named Bharatiya Mahila Bank was formed. The negotiations for merging of the 6 associate banks (State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala, State Bank of Travancore and Bharatiya Mahila Bank) by acquiring their businesses including assets and liabilities with SBI started in 2016.[18][19] The merger was approved by the Union Cabinet on 15 June 2016.[20] The State Bank of India and all its associate banks used the same blue Keyhole logo. The State Bank of India wordmark usually had one standard typeface, but also utilized other typefaces.

On 15 February 2017, the Union Cabinet approved the merger of five associate banks with SBI.[21] What was overlooked, however, were different pension liability provisions and accounting policies for bad loans, based on regional risks.[22]

State Bank of India Mumbai LHO

The State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of Travancore, and Bharatiya Mahila Bank were merged with State Bank of India with effect from 1 April 2017.

Non-banking subsidiaries

Apart from five of its associate banks (merged with SBI since April 1, 2017), SBI also has the following non-banking subsidiaries:

SBI Capital Markets Ltd- SBI Funds Management Pvt Ltd

- SBI Factors & Commercial Services Pvt Ltd

SBI Cards & Payments Services Pvt. Ltd. (SBICPSL)- SBI DFHI Ltd

- SBI Life Insurance Company Limited

- SBI General Insurance

In March 2001, SBI (with 74% of the total capital), joined with BNP Paribas (with 26% of the remaining capital), to form a joint venture life insurance company named SBI Life Insurance company Ltd.

In 2004, SBI DFHI (Discount and Finance House of India) was founded with its headquarters in Mumbai.

Other SBI service points

As of 31 March 2017, SBI group (including associate banks) has 59,291 ATMs.[23]

Since November 2017, SBI also offers an integrated digital banking platform named YONO.

As on 31 March 2017,[1] Government of India held around 61.23% equity shares in SBI. The Life Insurance Corporation of India, itself state-owned, is the largest non-promoter shareholder in the company with 8.82% shareholding.[24]

| Shareholders | Shareholding |

|---|---|

| Promoters: Government of India | 61.23% |

| FIIs/GDRs/OCBs/NRIs | 11.17% |

| Banks & Insurance Companies | 10.00% |

| Mutual Funds & UTI | 8.29% |

| Others | 9.31% |

| Total | 100.0% |

The equity shares of SBI are listed on the Bombay Stock Exchange,[25] where it is a constituent of the BSE SENSEX index,[26] and the National Stock Exchange of India,[27] where it is a constituent of the CNX Nifty.[28] Its Global Depository Receipts (GDRs) are listed on the London Stock Exchange.[29]

Employees

State Bank Institute of Credit, Risk and Management, Gurgaon

SBI is one of the largest employers in the country with 209,567 employees as on 31 March 2017, out of which there were 23% female employees and 3,179 (1.5%) employees with disabilities. On the same date, SBI had 37,875 Scheduled Castes (18%), 17,069 Scheduled Tribes (8.1%) and 39,709 Other Backward Classes (18.9%) employees. The percentage of Officers, Associates and Sub-staff was 38.6%, 44.3% and 16.9% respectively on the same date. Around 13,000 employees have joined the Bank in FY 2016-17. Each employee contributed a net profit of ₹511,000 (US$7,400) during FY 2016-17.[1]

Recent awards and recognition

- SBI was ranked 232nd in the Fortune Global 500 rankings of the world's biggest corporations for the year 2016.[12]

- SBI was 50th most trusted brand in India as per the Brand Trust Report 2013,[30] an annual study conducted by Trust Research Advisory, a brand analytics company and subsequently, in the Brand Trust Report 2014, SBI finished as India's 19th most trusted brand in India.[31][32]

See also

- List of largest banks

- John Mathai

References

^ abc "Annual Report [2016-17] of State Bank of India" (PDF).

^ "State Bank of India Consolidated Yearly Results, State Bank of India Financial Statement & Accounts". www.moneycontrol.com. Retrieved 2017-06-26.

^ "State Bank of India Yearly Results, State Bank of India Financial Statement & Accounts". www.moneycontrol.com. Retrieved 2017-06-26.

^ "From Imperial Bank to State Bank" (PDF). Retrieved 28 June 2017.

^ "Fortune Global 500 list". Retrieved 22 May 2018.

^ "Away from the public gaze, State Bank of India is preparing to unleash a revolution". Retrieved 22 May 2018.

^ Rajesh. Banking Theory Law N Practice. Tata McGraw-Hill Education. p. 8. Retrieved 4 November 2014.

^ "Indian Banks' Association". Iba.org.in. 23 April 2005. Retrieved 21 December 2010.

^ Business Standard (21 June 2010). "Approvals for State Bank of Indore merger by July: SBI".

^ Economic Times (26 August 2010). "State Bank of Indore branches to become SBI units from Aug 26 : SBI". The Times of India.

^ "Arundhati Bhattacharya, the first woman to head SBI".

^ abc "Fortune 'Global 500' 2016:State Bank of India". CNN. Retrieved 10 October 2016.

^ "SBI takes lead in opening bank accounts under Jan Dhan Yojana". The Economic Times. 11 September 2014. Retrieved 30 September 2014.

^ "SBI Annual Report 2014-15". State Bank of India. Retrieved 14 January 2016.

^ http://www.sbimauritius.com/new/files/about.php

^ "State Bank of India set to open second branch in China". The Hindu. Retrieved 1 June 2017.

^ "State Bank of India Acquired 76% Shareholding in Giro Commercial Bank in 2005". Accessmylibrary.com. 8 October 2005. Retrieved 21 December 2010.

^ "Five associate banks to merge with SBI". 18 May 2016. Retrieved 1 July 2016 – via The Hindu.

^ Iyer, Aparna (17 May 2016). "SBI merger: India may soon have a global Top 50 bank". Retrieved 1 July 2016.

^ "SBI merges with 5 associates: New entity set to enter world's top 50 banks list". Mumbai: Financial Express. 16 June 2016. Archived from the original on 16 June 2016. Retrieved 16 June 2016.

^ "Ahead of merger with SBI, associate SBT to raise up to Rs 600 crore". The Economic Times. Retrieved 18 February 2017.

^ [1][2]Pension liability provisions and accounting policies for bad loans

^ "Reserve Bank of India List of ATM's and POS".

^ "Stake in PSBs: LIC holding drops as stress mounts". The Indian Express. 2016-02-15. Retrieved 2017-03-28.

^ "State Bank of India". BSEindia.com. Retrieved 11 October 2013.

^ "Scripwise Weightages in S&P BSE SENSEX". BSE India. Retrieved 11 October 2013.

^ "State Bank of India". NSE India. Retrieved 11 October 2013.

^ "Download List of CNX Nifty stocks (.csv)". NSE India. Retrieved 11 October 2013.

^ "SBID State Bank of India GDR (Each Rep 2 SHS INR10)". London Stock Exchange. 11 October 1996. Retrieved 11 October 2013.

^ "Brand Mahatma lags behind Sachin, Aamir: Study". India Today. 28 January 2011. Retrieved 10 October 2013.

^ "The Economic Times".

^ "Brand Trust Report 2014". Archived from the original on 24 October 2014.

External links

| Wikimedia Commons has media related to State Bank of India. |

- Official website